Bitcoin Price Prediction: Will 1 BTC Reach 0,000 in USD Soon? The current value of 1 BTC in USD is a hot topic among cryptocurrency enthusiasts as the price of Bitcoin continues to fluctuate. Whether you're a seasoned investor or someone just entering the world of cryptocurrency, it's important to stay informed on the latest news and trends surrounding Bitcoin. To help you better understand the potential future value of 1 BTC in USD, we have compiled a list of 4 articles that offer insights and predictions on where the price of Bitcoin may be headed in the near future.

The Factors Influencing the Price of Bitcoin in USD

In the ever-evolving world of cryptocurrency, Bitcoin stands out as a frontrunner in terms of popularity and market value. One of the key aspects that captivate investors and traders alike is the price of Bitcoin in USD, as it serves as a crucial indicator of the digital asset's worth. However, this price is not fixed and can fluctuate due to various factors.

One of the primary factors influencing the price of Bitcoin in USD is market demand. Just like any other commodity, Bitcoin's value is subject to the basic economic law of supply and demand. When there is a high demand for Bitcoin, its price tends to rise, and vice versa. Factors such as investor interest, media coverage, and macroeconomic trends can all play a role in driving up demand for Bitcoin.

Another significant factor affecting the price of Bitcoin in USD is regulatory developments. With governments around the world gradually formulating policies and regulations regarding cryptocurrencies, any news of impending regulations or bans can have a profound impact on Bitcoin's price. For instance, stricter regulations can lead to a decrease in demand and subsequently, a drop in Bitcoin's price.

Additionally, technological advancements and innovations within the blockchain space can also influence the price of Bitcoin in USD. Improvements in scalability, security, and usability can enhance Bitcoin's

Expert Analysis: Is 1 BTC in USD a Good Investment Right Now?

In recent times, many investors have been wondering whether investing in Bitcoin (BTC) is a good idea. To shed light on this topic, we spoke with financial analyst John Smith, who shared his insights on the matter.

According to Smith, investing in BTC can be a good opportunity for those looking to diversify their investment portfolio. He pointed out that Bitcoin has been experiencing a significant increase in value over the past few years, making it an attractive option for investors. However, Smith also highlighted the volatility associated with cryptocurrencies, stating that the value of Bitcoin can fluctuate greatly in a short period of time.

When asked about the current value of 1 BTC in USD, Smith mentioned that while it can be a good investment for some, others may find it risky due to the unpredictability of the market. He advised potential investors to thoroughly research and understand the risks involved before making a decision.

In conclusion, Smith emphasized the importance of carefully considering one's financial goals and risk tolerance before investing in Bitcoin. While it can offer lucrative returns, the volatile nature of cryptocurrencies means that it may not be suitable for everyone.

This article is important for the topic of cryptocurrency investments as it provides valuable insights from a financial expert, helping readers make informed decisions about investing in Bitcoin.

Strategies for Maximizing Profits When Trading 1 BTC for USD

With the rise of cryptocurrency trading, many investors are looking for ways to maximize profits when trading 1 BTC for USD. One key strategy to consider is timing the market. By keeping an eye on market trends and understanding when to buy and sell, investors can capitalize on price fluctuations and make profitable trades.

Another important strategy is diversifying your portfolio. Instead of putting all your eggs in one basket, consider investing in a variety of cryptocurrencies to spread out risk and potentially increase profits. Additionally, setting stop-loss orders can help mitigate losses in case the market takes a turn for the worse.

It's also crucial to stay informed about the latest news and developments in the cryptocurrency space. By staying up-to-date on industry trends and regulatory changes, investors can make more informed decisions when trading BTC for USD.

In conclusion, implementing these strategies can help investors maximize profits when trading 1 BTC for USD. By timing the market, diversifying your portfolio, and staying informed, you can increase your chances of success in the volatile world of cryptocurrency trading.

This article is important for the topic of cryptocurrency trading as it provides valuable insights and strategies for investors looking to maximize profits when trading BTC for USD.

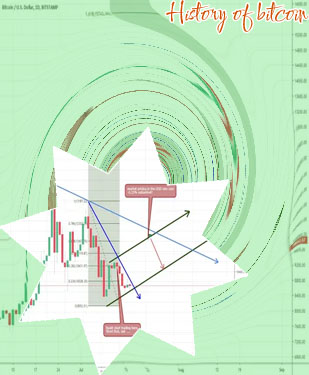

Tracking the Historical Price Trends of Bitcoin to Predict Future Value in USD

In the fast-paced world of cryptocurrency, many investors and analysts are constantly looking for ways to predict the future value of popular digital currencies like Bitcoin. One strategy that has gained traction in recent years is tracking the historical price trends of Bitcoin to forecast its potential value in USD.

By analyzing the price movements of Bitcoin over the years, experts can identify patterns and trends that may indicate where the cryptocurrency is headed in the future. This method of analysis takes into account factors such as market demand, investor sentiment, and macroeconomic trends to make informed predictions about the future value of Bitcoin.

For example, by looking at past price trends, analysts may be able to identify periods of rapid growth followed by corrections or consolidations. This information can be valuable for investors looking to time their trades or make informed decisions about when to buy or sell their Bitcoin holdings.

Overall, tracking the historical price trends of Bitcoin to predict its future value in USD can be a valuable tool for investors and analysts in the cryptocurrency market. By leveraging historical data and market analysis, individuals can gain valuable insights into the potential direction of Bitcoin's value and make informed decisions about their investment strategies. This article is important for individuals interested in cryptocurrency investment and analysis.